It’s comical to hear the screams from Wall Street, the Trump administration and the talking heads freaking out over the recent small rise in short-term interest rates, rightly put in place by the Federal Reserve.

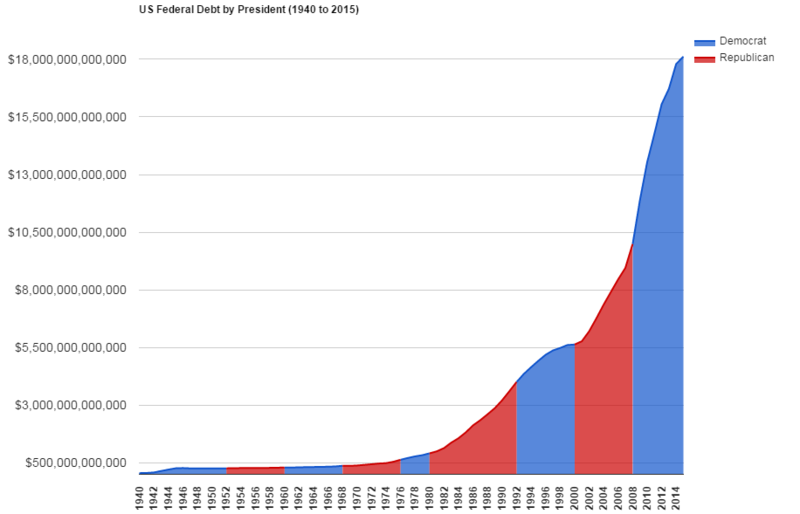

As President Trump’s policies bolster the economy and ramp up growth rates, interest rates should be heading higher to ward off inflation. We have spent the last 50 years running up ridiculous levels of liabilities; now it is time to pay the piper.

Economic weakness creates military weakness, a relationship borne out time after time over the millennia. Many of us have been screaming about the risks of excessive sovereign debt for a decade now, our warnings falling on deaf ears.

I even wrote a thriller called “Currency” about this subject upon leaving Wall Street at the end of 2011, trying to get someone to listen. From my years trading emerging market debt, I know firsthand the high rates that investors insist upon when faced with a pitch to buy the sovereign bonds of high-risk countries.

At some point, the U.S. will face the same demands. At some point, the market will take back control of interest rate levels from the Fed as buyers start wondering if America has the will — let alone the ability — to pay back what it owes the world. There is an old Wall Street saying, “Interest rates are low — until they’re not.”

People have been watching and listening, however, in Moscow and Beijing. Russia and China understand fully the irresponsibility, the extreme negligence, of our leaders who have run up a huge amount of debt that future generations must one day pay off. The baby boom generation truly has been the weakest generation of Americans. When it comes to self-absorption, millennials have nothing on boomers.

Russia has been building up its gold reserves and seeking an alternative to the U.S. dollar as a reserve currency. Moscow now holds the world’s fifth largest gold hoard after the United States, France, Germany and Italy. The Kremlin has also invested a lot of time and money in cryptocurrency, a technology that reportedly fascinates President Vladimir Putin.

China, famous for its opaque and misleading statistical reporting, only updates its gold reserve numbers every so often. It is safe to say that its real stock of gold reserves is much higher than Beijing lets on.

Both countries are preparing for war, a war where financial might will be critical to victory. Just ask Britain, Spain or the Germans about the idiocy of devaluing your currency. History rhymes.

America still enjoys the benefits the Bretton-Woods Agreement put in place after World War II, which codified the dollar as the world’s trading and reserve currency, ironically to try and prevent the financial and currency fights that fueled the great conflicts of the first half of the 21st century. U.S. strategists needs to prepare for this home-field advantage to go away. It is only a matter of time.

We have reached the point where even a small 25-basis-point rise in rates can incur tens of billions of dollars in additional debt service costs, debts that will eventually crowd out all other federal spending. Our leaders know this; they just can’t be bothered to act.

But a small rate jump is not what is coming. The average rate for the U.S. 10-year bond is around 5 percent. We are still well below that. Just to get back to the historic average, we are talking about a huge rise in annual debt service costs. At some point, we could see even investors demanding double-digit rates for our debt due to our financial irresponsibility.

There is an old saying: If you’re in a hole, the first thing to do is stop digging. America needs to face the debt issue now because very soon it will be too late.

And yes, China and Russia, sitting on their mountains of gold, understand all this very well.

Originally posted at The Washington Times