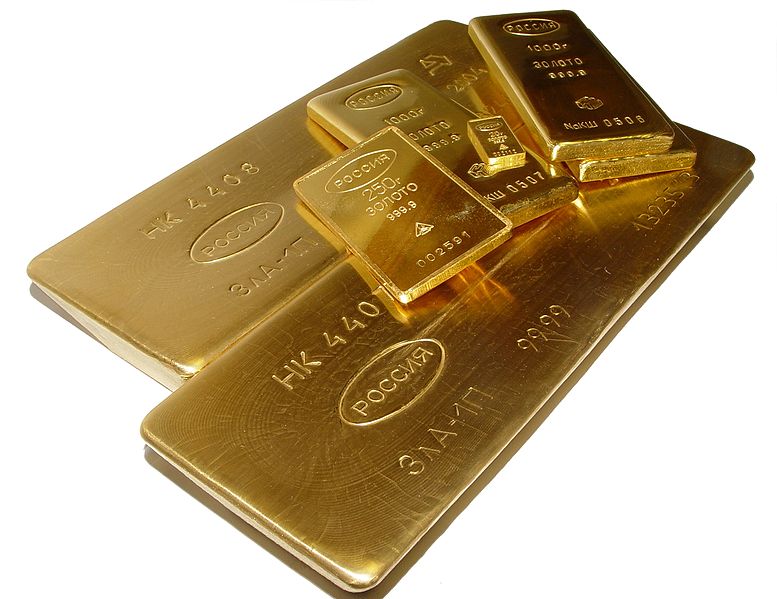

Image by History of Geo

Russia has been buying gold – a lot of it. Today the Bank of Russia announced it has bought enough of the barbaras relic to build the fifth largest stockpile in the world. This all happened as Russia reduced its ownership of American sovereign bonds to almost zero under the weight of sanctions from the United States and the European Union over the Kremlin’s actions in Ukraine in 2014.

Smashing Book Review By Banker’s Umbrella! The Novel Currency By L Todd Wood

In 2018, Russia’s buying jumped further as holdings of U.S. Treasury securities were reduced after Washington imposed sanctions on Russian entities in April, the toughest since Moscow’s 2014 annexation of Crimea from Ukraine.

The central bank bought 8.8 million troy ounces last year, it said on Friday, beating a record 7.2 million ounces set in 2017. As of Jan. 1 this year, the central bank held 67.9 million ounces of gold, up from 59.1 million ounces at the start of 2018, making it the world’s fifth largest holder behind the United States, Germany, France and Italy, reported Reuters.

Russia Has Drawn Up Plans To Ditch The Dollar

Russia, and its allies in Iran, China, have been actively working to ‘de-dollarize’ their economies. The greenback-based global financial system was set up at the end of WWII in an attempt to prevent financial and currency issues from causing armed conflict. Ironically, this system now gives America hegemony over other country’s economic health. This is obviously not a sustainable situation for most regimes, especially those that are American adversaries.

Since Russia’s economy is still primarily based on hydrocarbon production, the removal of the dollar in oil and gas transactions is also paramount for Moscow, as well as the development of non-dollar based payment transfer systems that will exclude Russia and others from American banking hegemony as well.

In addition, the sovereign debt of the United States continues to balloon with no end in sight. At some point, the market will begin to wonder if America has the ability, or the will, to pay even the interest on what it owes. At this point, U.S. interest rates could skyrocket, causing a severe, economic shock, and a currency devaluation.

At that point, Russia, and China, will be sitting fat and happy on their piles of gold.