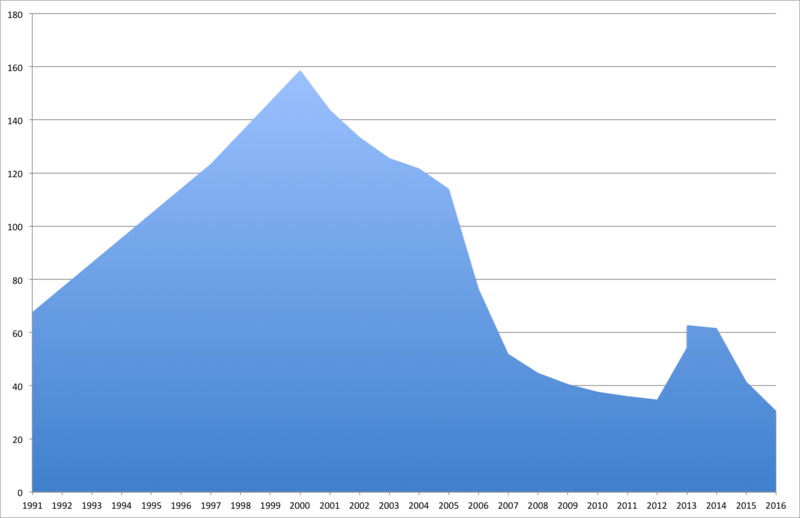

Russia External Debt Graph

Russia is moving back into the sovereign debt market in a big way. The Kremlin is looking to put in place procedures to allow investors to oversubscribe Russian treasury offerings going forward due to strong demand.

After months of uncertainty related to possible new U.S. sanctions on holdings of Russian debt, demand for OFZ treasury bonds soared this year. That’s led the finance ministry to rethink how it raises money for its budget needs.

The ministry has now scrapped offering limits at OFZ auctions after Moody’s rating agency in February lifted Russia’s sovereign rating, giving Russia an investment-grade rating by all three big international rating agencies, reported Investing.com.

This development is occurring because investors, especially those in emerging markets, see Western sanctions having less and less of an effect on Russian government operations.

“Some non-residents decided to take advantage of it as there is an understanding that if the sanctions occur, they are likely to impact new debt only,” Konstantin Vyshkovsky, head of the state debt department at the Finance Ministry, said. “Now we see a serious inflow of non-residents at the auctions.”

Russia, as well as China, Iran, and others have been looking for ways to reduce the hegemony of the United States in global finance and trade.